Partner with INFOCUS for your SAP GST Implementation:

How is your business going to change from July 2017?

GST stands for “Goods and Services Tax”, now a tax law awaiting implementation is proposed to be a comprehensive indirect tax levy on manufacture, sale and consumption of goods as well as services across the nation. It was introduced as The Constitution (One Hundred and First Amendment) Act 2016.It will replace and subsume all indirect taxes levied on goods and services by the Indian Central and State governments.

GST is expected to have a far reaching and wide impact on business, society and general economy. Goods and Services Tax - the upcoming revolutionary tax reform will bring unparalleled changes across all industries. The introduction of Goods and Services Tax (GST) would be a significant step in the reform of indirect taxation in India. Amalgamating several Central and State Taxes into a single tax would mitigate cascading or double taxation, facilitating a common national market.

It is also expected to address the current issue of inefficiencies in the tax system, prevent cascading impact of multi-level taxation, plug the revenue leakages and raise the transparency levels in business. The simplicity of the tax should lead to easier administration and enforcement. GST is expected to be applicable from 1 July 2017.

Improper and inaccurate GST implementation, and lack of preparedness, can lead to disappointing consequences and disastrous results for business owners and consumers. As a market leader in enterprise applications - SAP is ready to empower businesses with customized industry specific solutions ensuring a smooth GST implementation.

SAP estimates that Implementation of GST will lead to 3-5 billion invoice uploads every month. SAP predicts that at least 40% of these will pass through a SAP-enabled system.

Is your SAP system ready for GST?

GST will change the way businesses function in India, impacting almost all operations and processes. Supply chain and business network relationships with suppliers, distributors, contractors, 3rd party logistics and other business partners will transform completely. In due course of time business partners will become more integrated and will require real time updates and information flow over digital business networks.

SAP solutions will not just enable seamless transition to a GST complaint system but will also enable businesses to achieve greater profitability and to realize the full potential of benefits accruing from digital transformation in the post-GST India. As a SAP partner we do have a responsibility to not just help businesses get compliant with the new law, but also ensure that businesses benefit from the GST vision.

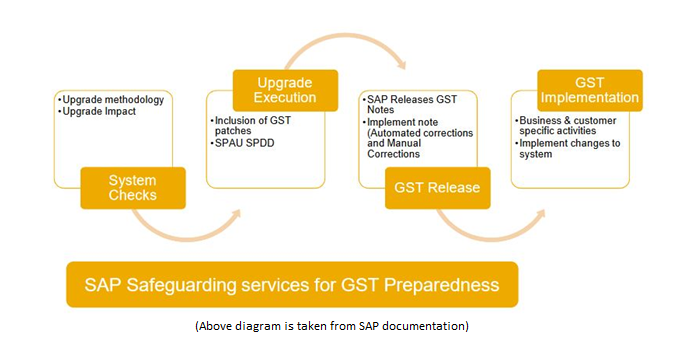

The Transformation Roadmap

Customer specific steps towards compliance:

GST India mandates B2G Tax Reporting:

The introduction of Goods and Services Tax (GST) in India, brings in a new regime of tax compliance, moving from filing of tax reports to a model based on data communication between the tax payer and the GST Network (GSTN) organization.

Two new entities, GST Suvidha Provider (GSP) and the Application Service Provider (ASP), are introduced by GSTN. Their roles are to facilitate the data communication to the GST system at GSTN in the required format.

The tax data communication of the taxpayer to the GST system shall be routed from the ASP via the GSP. The government propose to collect details of Outward Supplies, ISD Details and GST deducted at Source (TDS) from each taxpayer through this process. On a monthly basis, the GST system collates the information at your organization (GST registration) level and provides you the information on your inward supplies. This information then forms the base for the determination of the Input Tax Credit that you can avail when determining the GST payable.

The new process brings in a paradigm shift in the indirect tax determination in India with the source of truth for the input tax credit shifts from the taxpayer’s system to the GSTN system.

It now becomes imperative to have a solution that shall help you collate the required information from multiple landscapes, facilitate activities like input credit reconciliation and provide the ability to communicate with the GST system.

Download the Digital Compliance Service for India solution Overview

This solution which is offered on SAP Cloud Platform shall offer consolidation capabilities at a GST Registration level of your organization, of data from disparate systems and is designed around a framework driven approach for reporting.

Key features of the solution include- Scalability, High Transaction Volume management, Data Security and Supply Data Consolidation. From a security standpoint, additional features of the solution shall include Data Authentication, Data Protection & Privacy, Archiving & Retrieval and Audit trail.

Scope of Services

- Details of Outward Supplies

- Details of Inward Supplies

- Input Credit Reconciliation

- Monthly Return

- ISD Return

- TDS Return

- Annual Return

- Data Transfer Monitor at ECC Level

Collect, Collate and Communicate

The SLH, Digital Compliance Service for India offers an end to end capability from transfer of supply invoice data from SAP ECC system to collation of information into the required format and the data communication with the GST system via the GSP.

The solution has been designed taking into account the same communication nomenclature and security protocols that GSTN has prescribed for the GSPs, including interfaces to authorized digital signature providers.

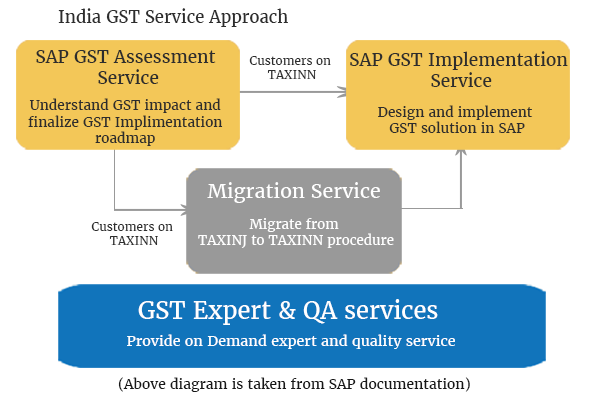

Services offered related to GST implementation:

- Assessment of SAP GST in your business

- SAP TAXINJ to TAXINN Migration Services.

- Support Pack upgrade in existing SAP system

- GST Implementation Services in existing SAP system

Why “Infocus” for GST Implementation?

- We have successful track record of upgrading support pack of GST across multiple projects

- Close association and partnership with CA firms to provide you required consultancy

- Highly experienced Finance and Tax functional team managed by Chartered Accountants

- Expert in TANINJ to TAXINN migration who have successfully handled multiple GST implementations

- Availability of automated tools for error free migration.

Please email us at sales@infocus-in.com or contact us today for all your GST related queries and implementation requirements.